|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Update – 15 October 2024 Australian Tin Resources Pty Ltd (ATR)

is making good progress with its pilot plant R&D activities and towards

achieving full scale commercial operations at its Ardlethan tin mine. The 10th shipment of tin concentrate

sold to Chinese smelters will occur this week and an 11th shipment will be

despatched to the overseas smelter by December this year. It is notable the Ardlethan tin mine is

currently one of only two operating tin mines in Australia. Earlier this year we installed a

multi-gravity separator (MGS) aimed at capturing and increasing the grade of

tin concentrate that would otherwise be lost to the tailings waste stream

after processing over the shaking tables. Commissioning of the MGS has

demonstrated very positive results. We are now contemplating the

installation of a ball mill to process the approx 50% of tailings volume

presently not captured by the Derrick and Landsky screens at the front end of

the process circuit. Assuming this proves successful, we will be able to more

fully utilize the 30tph design capacity of the existing processing circuit

and significantly increase grades and recoveries of tin (Sn) concentrate for

sale to the overseas smelter. However, rather than processing the

entire tailings oversize volume through the ball mill, we are first

investigating if we can reduce the volume fed to the ball mill and from the

ball mill to the spirals, using pre-concentration technologies to capture and

upgrade the <125 micron tailings feed containing about 0.11% Sn, and

screen out the >125 microns which contains little tin. To achieve this, we envisage a two-step

process aimed at providing up to a 4 times upgrade of the tailings oversize,

with 80% Sn recovery. Towards this end we recently sent samples of the

oversize tailings to Gekko to test the upgrade and recovery they can achieve

with their in-line pressure jig (IPJ), to Newcastle University to test the FL

Schmidt reflux classifier, and to Mineral Technolgies, to test whether

additional spirals might be added to the existing circuit. We also

investigated the use of conventional jigs and revisited previous test results

of the Falcon classifier, because unlike previous Falcon testing targeting

ultra-fine tin tailings (<106 microns), we are now targeting the >106

micron fractions which we understand is potentially a sweet spot for the

Falcon. R&D of these technologies

continues. We have contracted to rent a laboratory scale Reflux Classifier to

test it in the plant for 3 months commencing in November this year. However, having regard to the cost, benefit

and lead-time of incorporating pre-concentration in our R&D program and

our wish to accelerate the transition to full commercial operations, we have

also procured conventional jigs which we will install into the process

circuit as soon as possible. It is only after we can assess the pre-concentation

effectiveness of the jigs that we will be able to establish the size the

required ball mill. With about six months to procure the

required pre-concentration equipment and complete the ball mill installation,

it will not be until the end of the first quarter of 2025 that we will be

able to more fully utilise the production capacity of the existing 30 tph

spiral plant and commence full scale commercial production. During pilot plant testing we have been

working relatively low hours per week to minimise costs and process water

consumption while we investigate process refinements and improvements to

plant reliability and performance. However, we have recently been increasing

plant working hours as concentrate production volumes, Sn grades and

recoveries improve. With installation

of the ball mill, we will be on the cusp of finalizing commissioning of the

existing 30 tph plant and commencing full-scale commercial production, albeit

we will still have further improvements to the process circuit to be trialled

after production operations formally commence. In the meantime, by working additional

plant hours, we expect the operation to be cash flow positive. ATR’s intention is to progressively

ramp up production as we become increasingly satisfied that the production

process circuit is as efficient and reliable as we can reasonably achieve and

is operating on a financially viable basis. We are presently on the cusp of

this objective. We will do this in a step-by-step manner as potential process

improvements are tested and implemented, by increasing hours worked each week

and by adding additional production capacity to the plant process circuit. People underestimate the time and cost

associated with gaining the necessary approvals to transition from

exploration to production. ATR has submitted all environmental plans and

other data to the various government authorities as required by Council’s Development

Approval Conditions of Consent for a 1.5 million tonne per annum operation

and has all necessary approvals, including Environmental Protection Licence

Number 21797 granted to us on 6 July 2023 for Large Mine operations, so there

are no regulatory impediments to our commencing full scale production

operations whenever it suits us. With approvals already in place for

tailings retreatment at 150 tonnes per hour and with potential production of

1,000 tonnes of tin in concentrate per annum from tailings alone, ATR will be

seeking partners with capital and expertise to progressively increase our

rate of production from the present 30 tph plant capacity.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

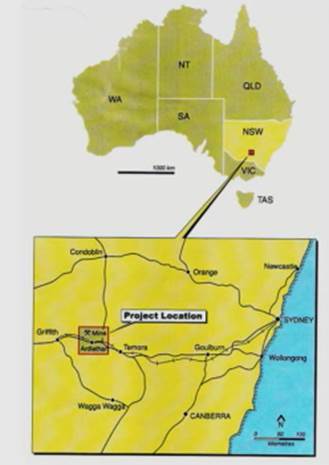

The Ardlethan Tin Mine is located

approximately 500 km southwest of Sydney, NSW, 5 km NW of Ardlethan township.

It covers about 400 hectares on land wholly owned by EOE (No 75) Pty Ltd

(EOE), a wholly owned subsidiary of Australian Tin Resources Pty Ltd (ATR). Excellent road and rail access is

available within close proximity to the site. Additionally, an approx.50km

pipeline from the Murrumbidgie River at Grong Grong to site is now

decommissioned, but subject to approval could potentially be reinstated if

required.

The plant is presently powered by

diesel generators. However, there is an electrical substation in Tin Mine

Road, about 2.0km from the mine site, should ATR wish to reconnect to the

main electricity grid. Mining at Ardlethan commenced in 1912.

At first it was on a small scale, but between 1965 and 1986 Aberfoyle

Resources NL around 30 million tonnes of granite, initially from open cut

operations and later from underground workings. Of the approx 30 million tonnes mined,

Aberfoyle processed about 9.0m tonnes of ore assaying 0.46% tin. The

remaining 21 million tonnes (approx) had a tin content below Aberfoyle’s

cut-off grade of 0.20% tin and was stockpiled in overburden waste dumps which

surround the open cuts. In 2020 ATR carried out very successful tests offsite

to trial a Tomra Ore Sorter on a bulk sample of our waste rock. The results

were impressive with high upgrade rates being achieved and pointed to the

feasibility of viably processing the waste rock as a future option. Additionally, the under-explored

underground Ardlethan tin mine hard rock resource offers an attractive future

opportunity in the longer term. Significant tin deposits have also been

identified by exploration drilling in potentially available leases adjacent

to the Ardlethan Tin Mine site.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

JORC certification and Ardlethan Tin Mine records

show there is at least 66,500 tonnes of contained tin on site. At the current

tin price of ~US$32,500/ tonne (A$50,000/tonne) this represents a value of

over A$3,000 million – a very worthwhile value proposition. The Ardlethan Tin Mine is one of only two operating

tin mines in Australia and the defined deposit places it in the top twenty

tin mines in the world. Importantly, the mine is being developed and

operated by ATR on the existing mine site previously operated by Abefoyle

until 1986. Unlike many resource

undertakings in Australia, ATR already has its approvals in place and does

not need to embark on the very onerous and expensive development consent and

environmental approval process required when a proposed mining undertaking

seeks to transition from exploration to production. The tin on the Ardlethan site is contained in three

areas as shown in the Resources summary below and more fully described in the

Resources section of this website.

*

Source: Reynard Australia Pty Ltd JORC Report, October 2011 ** Source: Ardlethan Information Brochure,

Molina & Doran, May 1989 When

the mine capacity and production is expanded to full operations, the

operating cost is expected to be in the bottom quartile of global tin mining

operating costs. Tin

is around 30 times rarer than copper and all tin mines operating today are

based on brownfield mining operations. No new tin resource has been found

anywhere in the world in more than 50 years. The Ardlethan tin mine dates

back to 1912 with artisanal mining operating on the site from the nineteenth

century. The

International Tin Association is predicting a shortfall in tin supply deficit

from next year (2025) driven by supply constraints from existing operators

and the growing demand for tin in Electric Vehicles and Solar panels. As

summarised in the Introduction Section above, there have been some challenges

in extracting the tin from the tailings which have a grade of only 0.2

percent tin. The company has been conducting research and development

activities based on the 2016 engineering and assessment of Mineral

Technologies, a respected global leader in the use of spirals to upgrade and

extract the tin contained in the tailings to a saleable grade of 50+% tin

concentrate. This has been successful with ten shipments sent, accepted and

paid for by Chinese smelters to date using our 15-30 ton per hour Pilot

processing plant Current

research and development activity is focused on increasing capacity, recovery

and grade from the existing 30 tonne / hour pilot plant by introducing

refinements in the processing circuit in a step-by-step manner. We are

presently planning to crush the oversize tailings oversize which is currently

not being processed but contains usable tin. This will be followed by further

capacity increases that will drive the cash operating cost below the lowest

quartile of production costs for global tin producers. Our

current approvals are for re-processing tailings. However, there may be

further opportunity to increase production by processing the above ground

waste rock which contains approximately A$1 billion of tin. Research using

Tomra ore sorting technology has shown this to be a very attractive option

for the future. Finally,

the development of the underground resource on our site, and potentially

expanding from our site into known resources neighbouring our leases, would

require significant capital and new approvals, but is technically straight

forward. It is likely this option would be undertaken by a larger and more

experienced mining operator. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

1. Tailings Retreatment

of the tailings from previous mining operations was the main driver for

Australian Tin Resources deciding to acquire the Ardlethan tin mine. ATR

now has DA approval to construct a 150 tonne per hour plant on site to

operate 24 hours/day, 7 days/week. However,

before moving to full scale production, ATR is firstly carrying out small

scale pilot plant processing operations on site to prove up and refine the

processing technology. We

will the upsize the plant from 30 tonnes per hour, to 60 tonnes per hour, and

ultimately to it’s approved 150 tonnes per hour capacity over time.

Source: Reynard Australia Pty Ltd JORC Report, October 2011 2. Waste Stockpiles The

Ardlethan mine contains approximately 21.3 million tonnes of granite

previously mined by Aberfoyle and now stored in waste dumps circling the open

cuts. Processing the stockpiled waste material represents a potential option

and is a comparatively low capital and operating costs option. Waste material

boulders typically range in size from approx 30cm to 100cms in diameter and

the waste dumps are readily accessible from existing mine haul roads. ATR

has obtained JORC certification of the waste material resources stockpiled at

the mine site as summarized in the table below. In

2020 ATR carried out very successful tests offsite to trial a Tomra Ore

Sorter on a bulk sample of our waste rock. The results were impressive with

high upgrade rates being achieved and pointed to the feasibility of viably

processing the waste rock as a future option.

Source: Reynard Australia Pty Ltd JORC Report,

October 2011 3. Hard Rock Mining of Underground

Resource The

table below summarises the hard rock mineral resources at the time of mine

closure in August 1986. These resources consist of broken ore in stopes,

remnants, pillars and resources inferred from drilling. Access would be via a

decline just north of the main Ardwest / Wild Cherry Open Cut. There

is further potential deeper underground on the mine site and in surrounding

environs. There are also some small deposits of known high grade ore at or

near the surface.

Source - Ardlethan Information

Brochure, Molina & Doran, May 1989. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Australian Tin Resources

Pty Ltd ABN 17 124 654 360 Registered Office: Level 4, 141 Walker Street North Sydney, NSW 2060 (PO Box 1506, North Sydney, NSW 2059). Australia Phone

+61-2-9959 5599 Site Office: Tin Mines Road, Ardlethan, NSW 2665) (PO Box 13, Ardlethan, NSW 2665) Australia. Phone 0437 772 256 Complaints: Phone 0437 772 256 Email: admin@atresources.com.au Contacts: Peter Francis - Director Mobile

0412 178 128 Email: pfrancis@atresources.com.au Glen Cunningham - Director Mobile 0412 058 773 Email: gcunningham@atresources.com.au Bill Lannen - Director Mobile 0418 330 583 Email: blannen@atresources.com.au Sam Boatwright - Site

Manager Mobile 0413 483 324 Email: samb@atresources.com.au |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||